Small Businesses Plan to Grow Despite Capital, Tax, and Trade Uncertainty

High interest rates are making it harder for small businesses to grow

51% of small businesses said that given current interest rates, they could not afford to take out a loan. 64% of small businesses said technical assistance for accessing capital (e.g., microloans or fintech tools) would help.

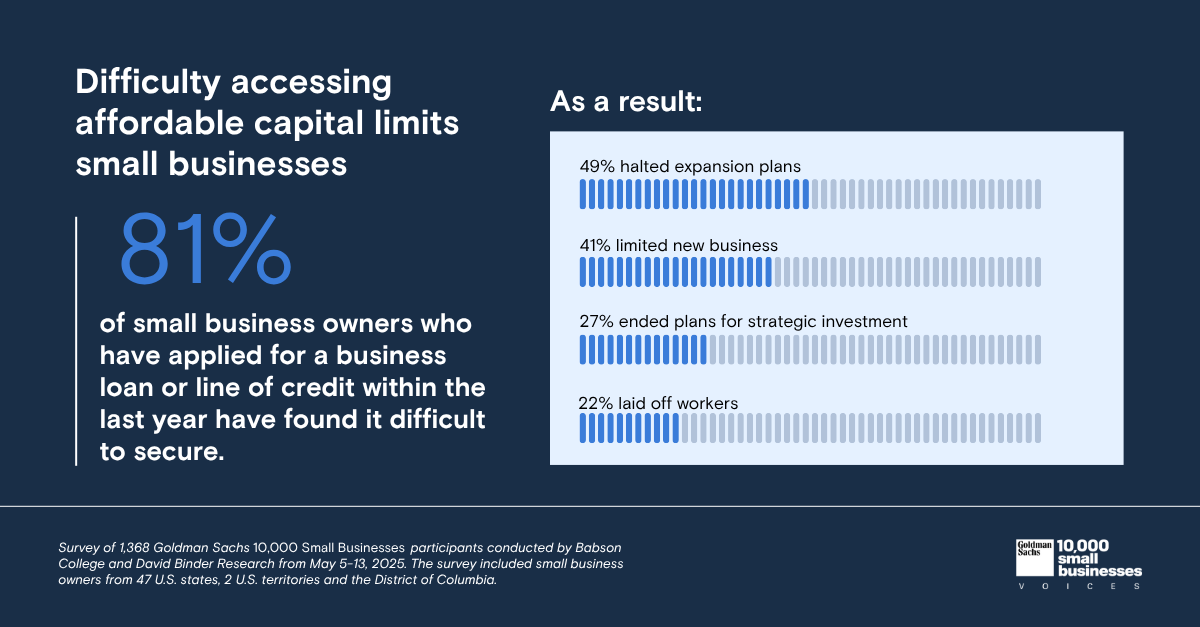

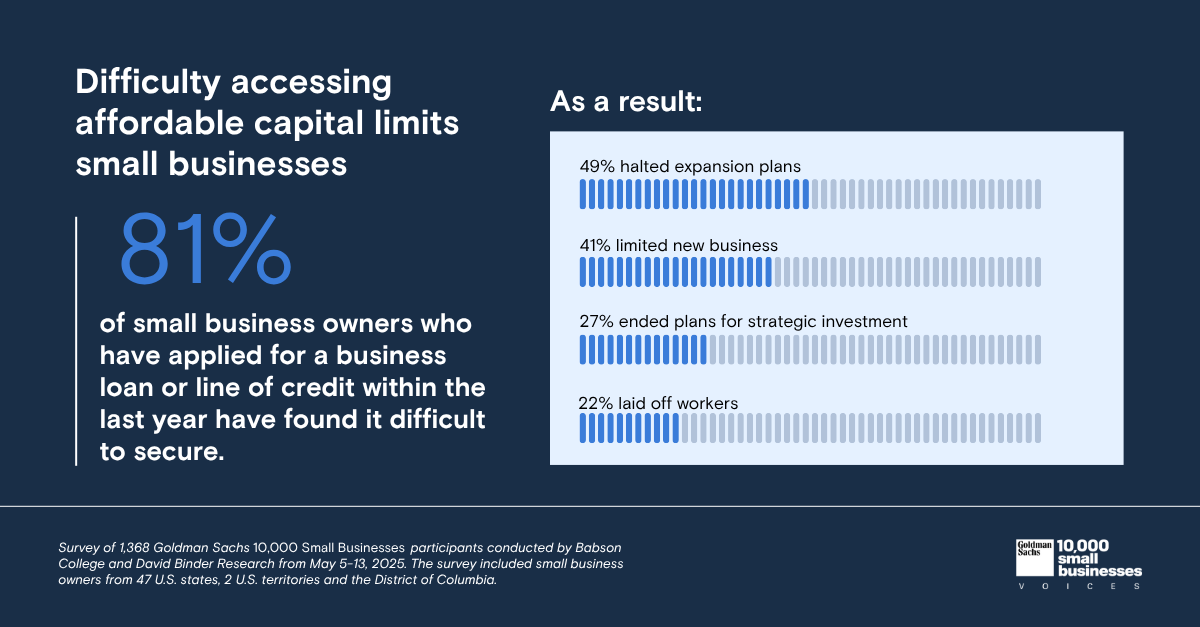

Among small business owners who have applied for a business loan or line of credit within the last year, 81% found it difficult to access affordable capital. Of those who had difficulty accessing capital, 49% said they halted expansion plans, 41% were limited in taking on new business, 27% ended plans for strategic investment and 22% laid off workers.

Small businesses want a simple, predictable federal tax code

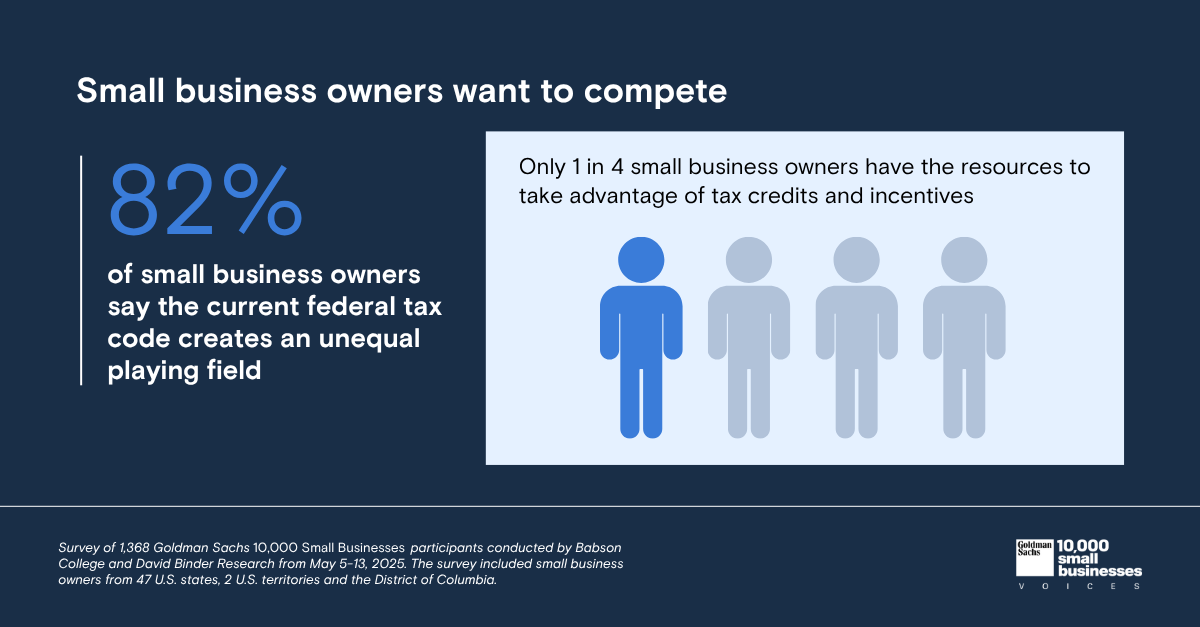

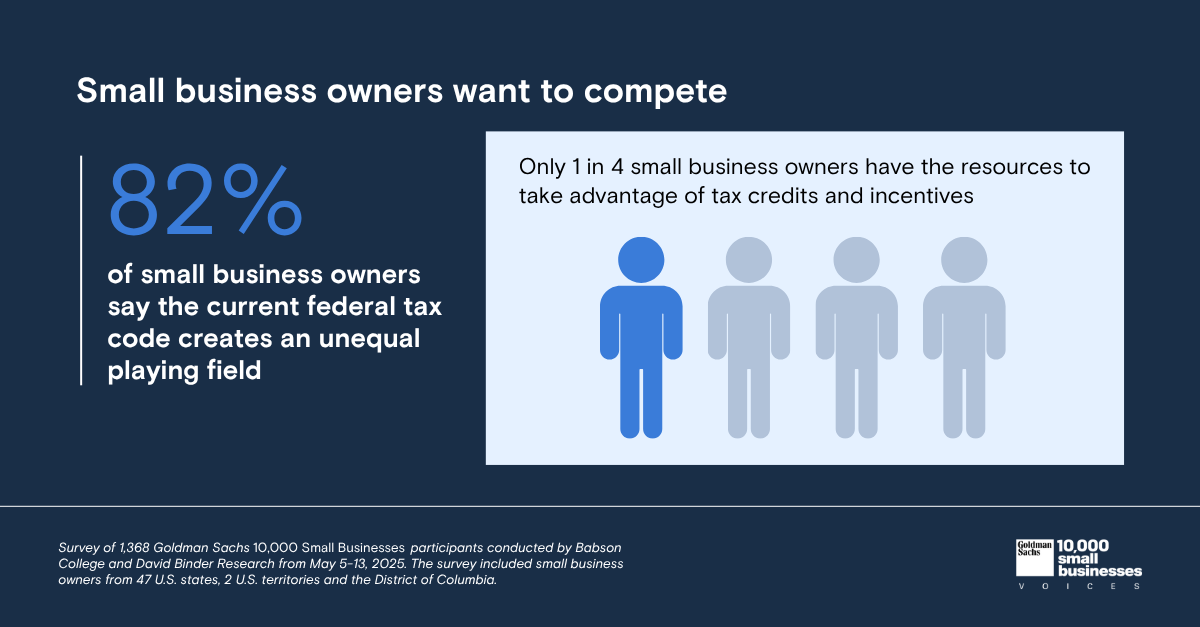

82% of small business owners say the current federal tax code creates an unequal playing field between large businesses and small businesses and over 90% say certainty, predictability, and simplicity in the federal tax code is important to their financial planning success.

Finding and using opportunities in the tax code takes resources and expertise. Only 25% of small business owners think they have the resources to take advantage of tax credits and incentives. Small business owners face a number of challenges with the tax code, including tax credits and incentives that are not scaled for businesses of their size (54%), overly complex and confusing policy (50%), and unpredictability and uncertainty (34%). 78% say they support the reinstating of full and immediate R&D expensing, and 70% say the costs they incur related to tax compliance are expensive.

Trade uncertainty is on small business owners’ minds

Small business owners currently feel (36%) or expect to feel (38%) negative impacts from tariffs. Of those who reported feeling or expecting to feel negative impacts from the tariffs most (77%) cite uncertainty as the cause.

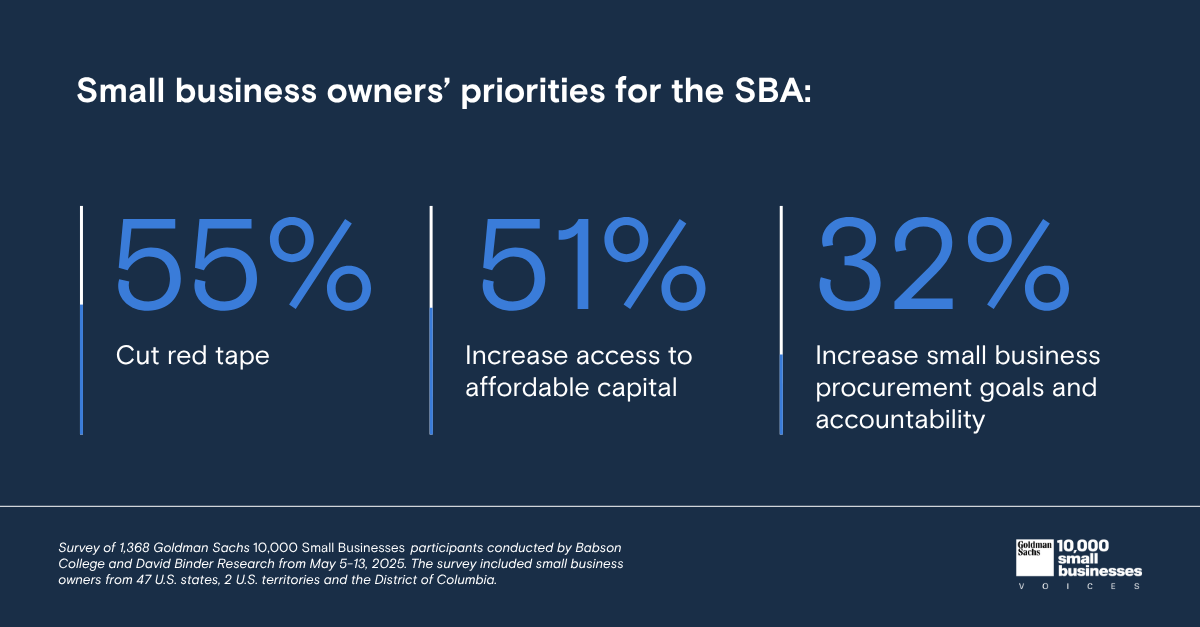

Small business owners are fighting red tape

80% of small business owners say that navigating complex regulations takes time away from managing and growing their businesses. They want the Small Business Administration (SBA) to focus on cutting red tape for small businesses (55%), increasing access to affordable capital (51%), and increasing small business procurement goals and accountability (32%).

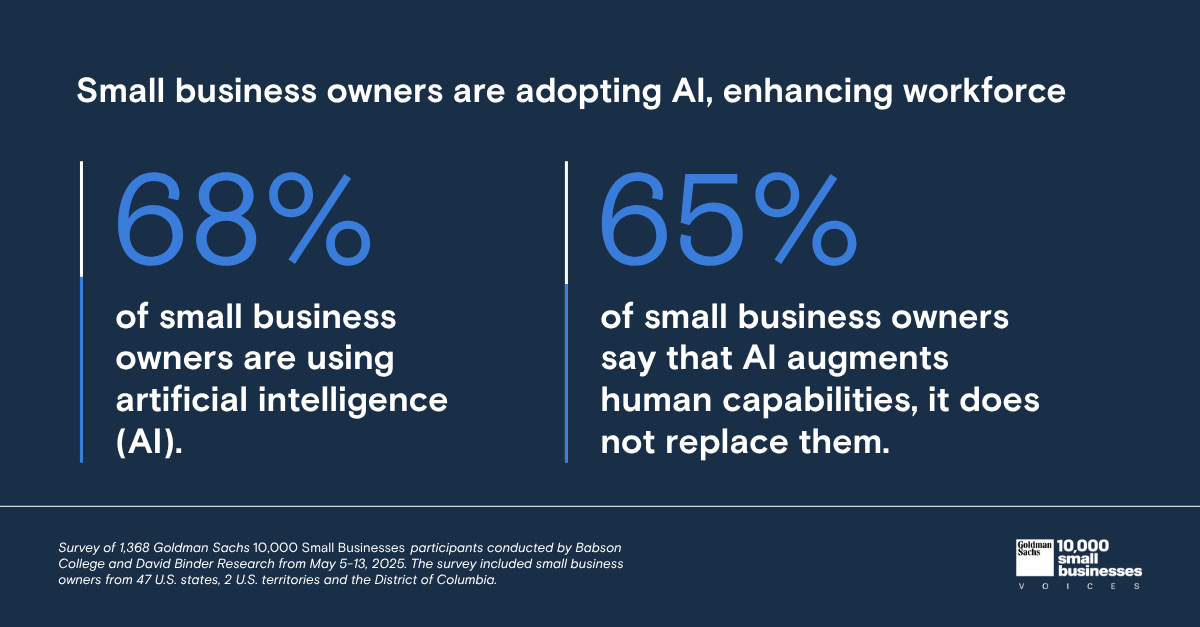

Small businesses are adopting AI, enhancing workforce

Small business owners are looking to the future and implementing new solutions to increase productivity and expand their capabilities. 68% report currently using AI with an additional 9% planning to begin using it within the next year.

Most small businesses state AI is enhancing—not replacing—their workforce (65%). Those using AI report increased efficiency and productivity (80%), better data for decision-making (51%), and new capabilities (49%). However, 42% of small businesses do not have access to the resources and expertise necessary to successfully deploy AI.

Small business owners want a voice in Washington

81% of small business owners say they don’t think small businesses are a priority in Washington right now and 86% do not believe small businesses have enough of a voice in Washington.

Survey of 1,368 Goldman Sachs 10,000 Small Businesses participants conducted by Babson College and David Binder Research from May 5-13, 2025. The survey included small business owners from 47 U.S. states, 2 U.S. territories and the District of Columbia.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newletter via email.