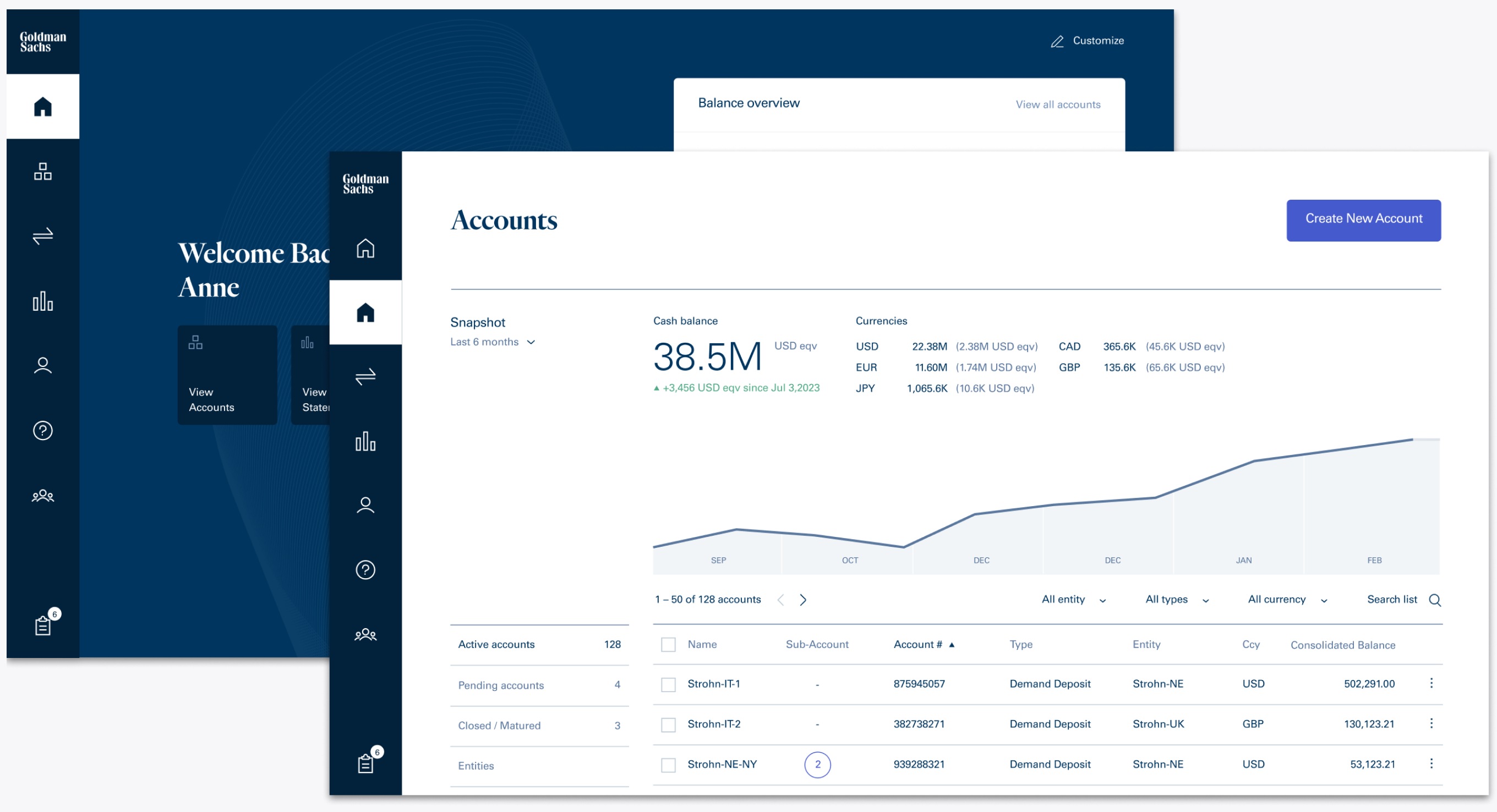

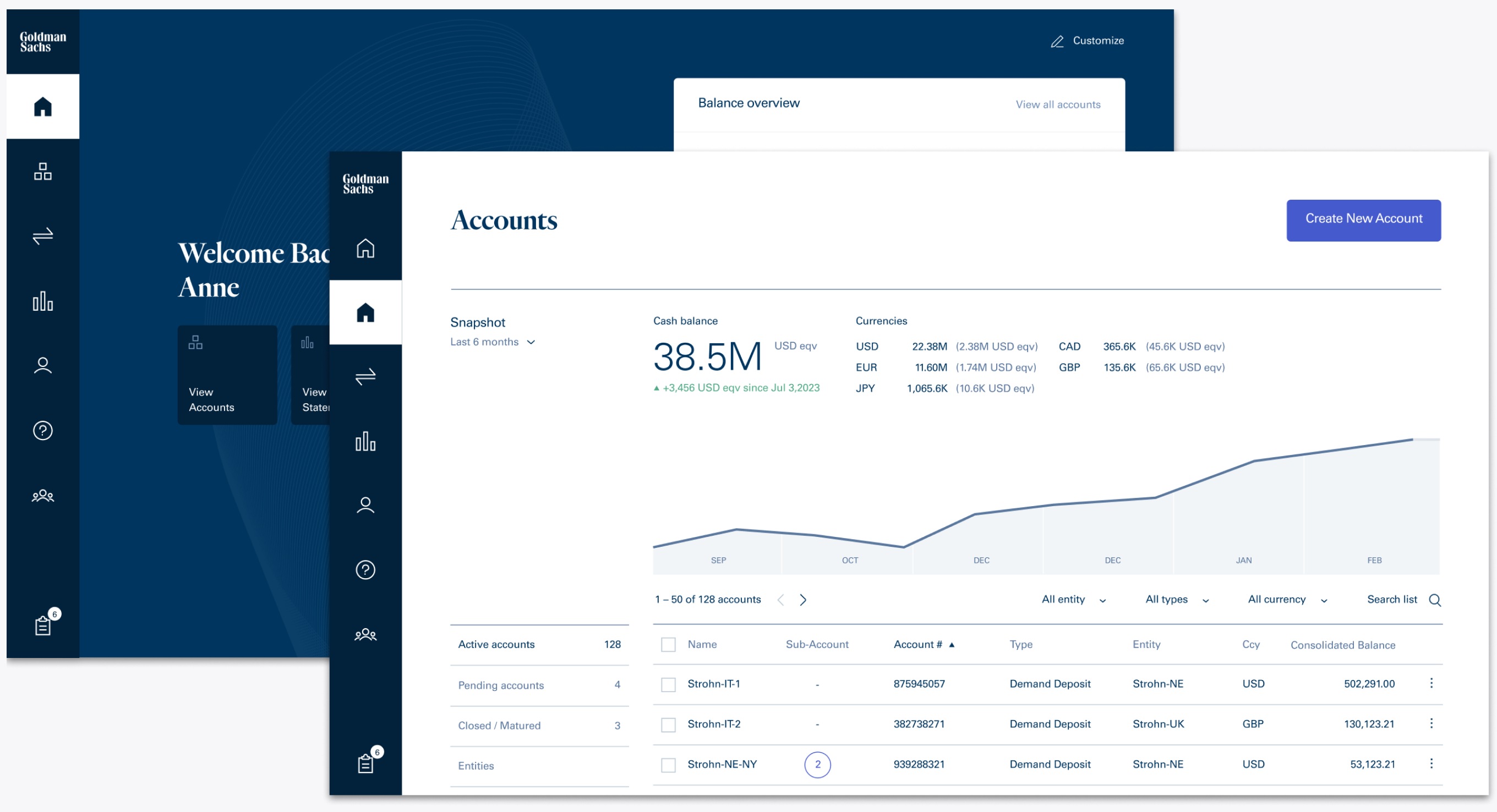

Digital Channels

Soft token authentication accessible via mobile phone as a part of TxB’s multi-factor authentication solution

Real-time¹ payment status visibility using TxB’s payment tracking tool, which includes SWIFT GPI tracking

Simple and responsive digital interface making it easy for treasury teams to operate

Use SWIFT, FileAct, NACHA & ISO file formats to execute domestic and foreign currency payments across ACH, Wire, and real-time rails

Catalogue of file samples and guides for payment initiation & reporting

Reporting supports multiple file formats, including BAI, CAMT 52/53, and MT 940/942

Clients can create, update, and delete virtual accounts, and better track money movement without the latency of manual reconciliation.

Single Payment API that is rail agnostic, so clients don’t need to implement additional APIs.

Clients can track changes to their account ledgers, including balances and transactions, ensuring their treasury position is accurately reflected.

Transaction Banking services are offered by Goldman Sachs Bank USA (“GS Bank”) and its affiliates. GS Bank is a New York State chartered bank, a member of the Federal Reserve System and a Member FDIC. For additional information, please see Bank Regulatory Information.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newletter via email.